Computer depreciation life

Computer hardware and software are subject to increasingly rapid. You would normally use MACRS GDS 5 year 200 declining balance to depreciate.

Inventory And Depreciation How To Be Outgoing Software Development Working Late

The current Effective Life estimates for computers under Table B are.

. This software can also be expensed under section 179. For our financial accounting at TechRepublic we use a three-year life for depreciating computer equipment. ADS is another option but as you might have already seen the recovery period is the same 5 years.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. However you will depreciate it on a straight line. Depreciable software acquired after 8101993 that is not an amortizable section 197 intangible asset is depreciated using straight-line over a three year period beginning on the first day of the month.

The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. You are right that computers are depreciated over 5 years. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

Depreciation on computer hardware and software over 1 year possible BACKGROUND. Alternatively you can depreciate the acquisition cost over a 5-year. The expense approach Why not record the entire purchase as an immediate expense.

Computers effective life of 4 years Under the depreciation formula this converts to a Diminishing Value. A depreciating asset is an asset that has a limited effective life and can reasonably be expected to decline in value over the time it is in use. From Jan 1 2021.

Deductible amount for computers used less than 100 percent of the time for. The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year.

The information provided herein was obtained and averaged from a variety of sources including but. Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. Tools equipment and other items such as.

153 rows Computer-to-plate CtP platesetters including thermal and visible-light platesetters and Direct-to-plate flexographic platesetters Computer digital imagers 5 years. The table specifies asset lives for property subject to depreciation under the general depreciation. The computer will be depreciated at 33333 per year for 3 years 1000 3 years.

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Nonprofit Accounting Basics

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Depreciation Nonprofit Accounting Basics

Depreciation In Excel Excel Tutorials Schedule Template Excel

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

P Amp L Statement Template Luxury P L Spreadsheet Inside Free Pl Statement Template Profit And Loss Statement Statement Template Small Business Plan Template

Depreciation Formula Calculate Depreciation Expense

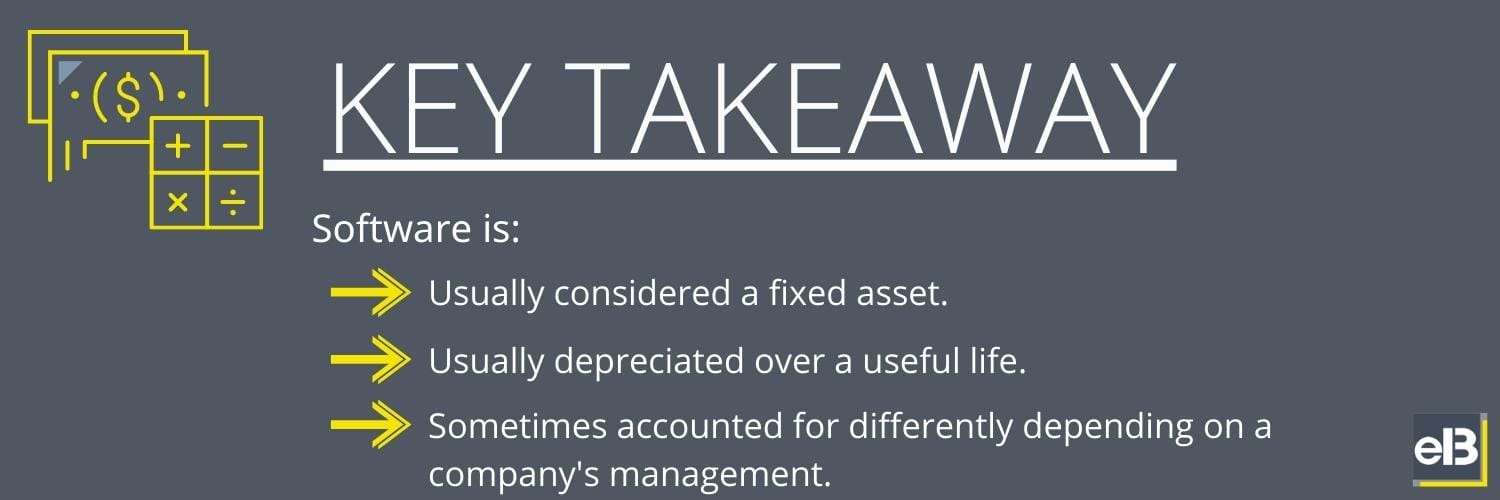

The Basics Of Computer Software Depreciation Common Questions Answered

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting